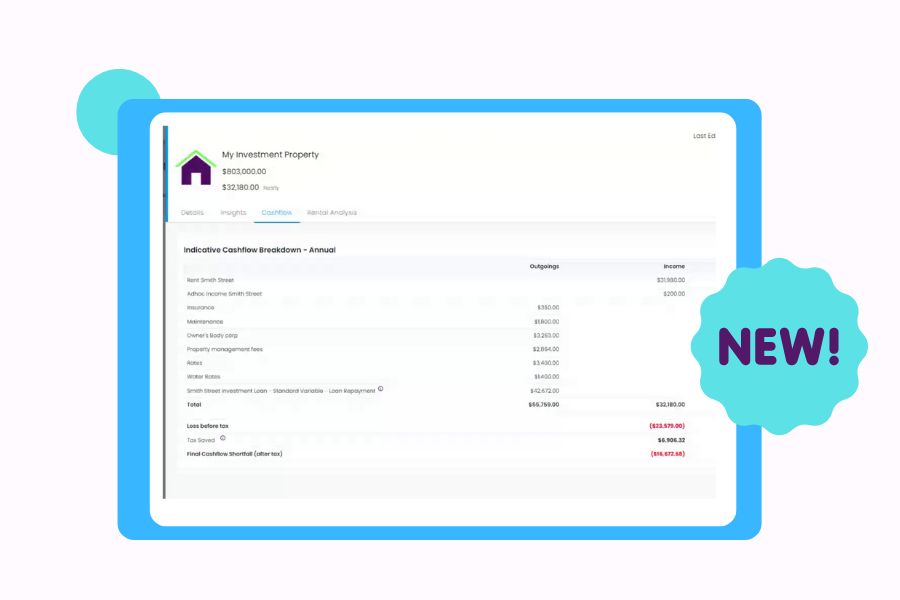

The first thing you need to check is that you haven’t incorrectly input any financial figures. This can often be the case, and a tip for beginners – always double check your payment frequencies, often I see annual figures that are being calculated monthly or weekly, which completely puts your values out of whack. Start with looking at your figures on the financial dashboard as this might give you a quick fix, when you see a value that looks out of step with reality.

If you are still in negative territory after this audit, then in theory the negative number really shouldn’t be a surprise to you, if you are living a bit of pay cheque to pay cheque. Your financials are telling you that your cashflow is going backwards or potentially your projected capital growth (%) figures are going backwards or both.

If you are carrying a lot of personal debt or debt in general and you can’t seem to get on top of your finances, it’s best to make an appointment with a financial counsellor. They will be able to look at your situation and hopefully create a pathway out of the any financial challenges you might be experiencing. And your financial snapshot in Moorr® will be of major help to them, so be sure to show them your Moorr® mobile app to help them assess your finances.

👉 Transform your financial journey with Moorr! Download on iOS here and Android here, for exclusive access to WealthSPEED, WealthCLOCK, MoneySMARTS, and more!