Depreciation can now be added to Investment Properties.

As a much requested addition, this latest update allows you to enter in the depreciation for each tax year, whether as a total sum, or as a breakdown of your Capital Works and Plant & Equipment (if applicable). It’s important to note that this is only intended for users with a valid depreciation schedule for the property.

Why has depreciation been added?

Depreciation serves as a deductible expense that doesn’t involve actual cash outlay, often enhancing the cashflows of an investment property, whether new or existing, without additional cost beyond the initial expense of acquiring the depreciation schedule. This is because, unlike other deductible expenses such as property management fees, depreciation is a non-cash deduction for the decline in value of depreciating assets, and thus requires no additional ongoing spending.

By leveraging depreciation, taxable income can be lowered, cashflow increased, and more funds retained. Even if an investment property has been owned for an extended period of time without a depreciation schedule, past tax returns can be adjusted to claim these overlooked deductions.

In essence, neglecting depreciation means potentially leaving money on the table.

As we strive for a more precise Moorr platform, this feature has been incorporated to ensure the utmost accuracy in your cashflow calculations.

Where can I add this in?

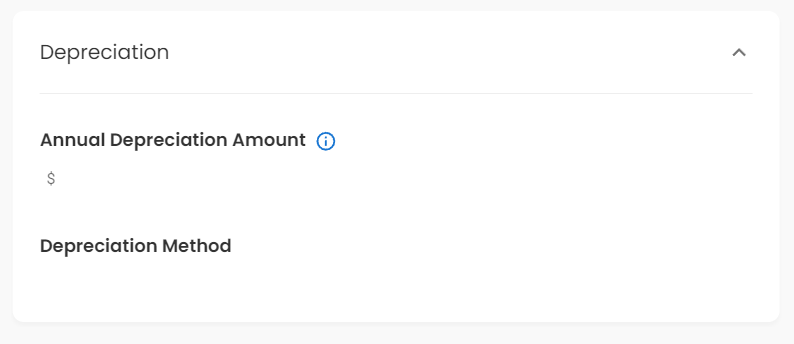

Under each of your Investment Properties (with a Primary Purpose of either ‘Investment Property’ or ‘Business Use’), you’ll see a new form where you can enter in your deprecation information.

You’ll find the space to add in an Annual Depreciation Amount and to log the Depreciation Method you are currently using.

This is also available for entry on the Mobile App.

If you have a property that was previously an Investment Property but has now been converted to an Owner Occupied property, you will still see the fields available for entry, however the data will not be included in your Investment Property Deduction Calculations for the next financial year onwards.

How it Works

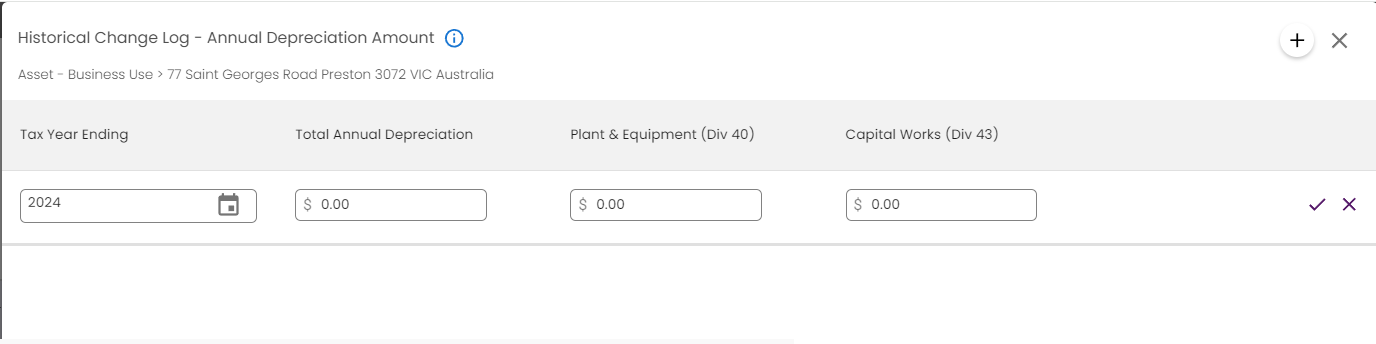

When entering in the Annual Depreciation Amount, you’ll be directed to the changelog for the Annual Depreciation field, which will allow you to enter in your depreciation for each tax year. You can do this by either entering the Total Annual Depreciation, or the Plant and Equipment + Capital Works independently (if entering in this way, the Total Annual Depreciation value will auto-update based on this calculation).

Note: For the Tax Year Ending 2024, it is referring to the tax period of 1 July 2023 to 30 June 2024. Data will be stored for this entry on 1 July 2023, so that calculations throughout that period will use this figure. Note that figures are not pro-rata’d.

How does depreciation affect the calculations in Moorr?

Depreciation is added to the total Investment Property Deductions calculation.

Investment Property Deductions on the platform are currently (as of April 2024) calculated as = Annualised Expenses on Investment Properties + (Interest on Investment Loans x Outstanding Balance on Investment Loans) + Total Annual Depreciation for the Current Tax Year. This then has an impact on your overall net income, which is used in various places on the platform, such as the Home Dashboard, Wealth Dashboard, MoneySMARTS, MoneyFIT and MoneySTRETCH.

–