Introducing MoneySMARTS 2.0

Since MoneySMARTS was first developed in 2008 and then released on our platform in 2017, the Moorr platform has evolved significantly. What this has meant is that the MoneySMARTS functionality in Moorr has been in a need of an update to ensure that MoneySMARTS remains firmly within the core of the Moorr ecosystem, allowing users to quickly track and update their values and keep their finances up-to-date.

What is MoneySMARTS?

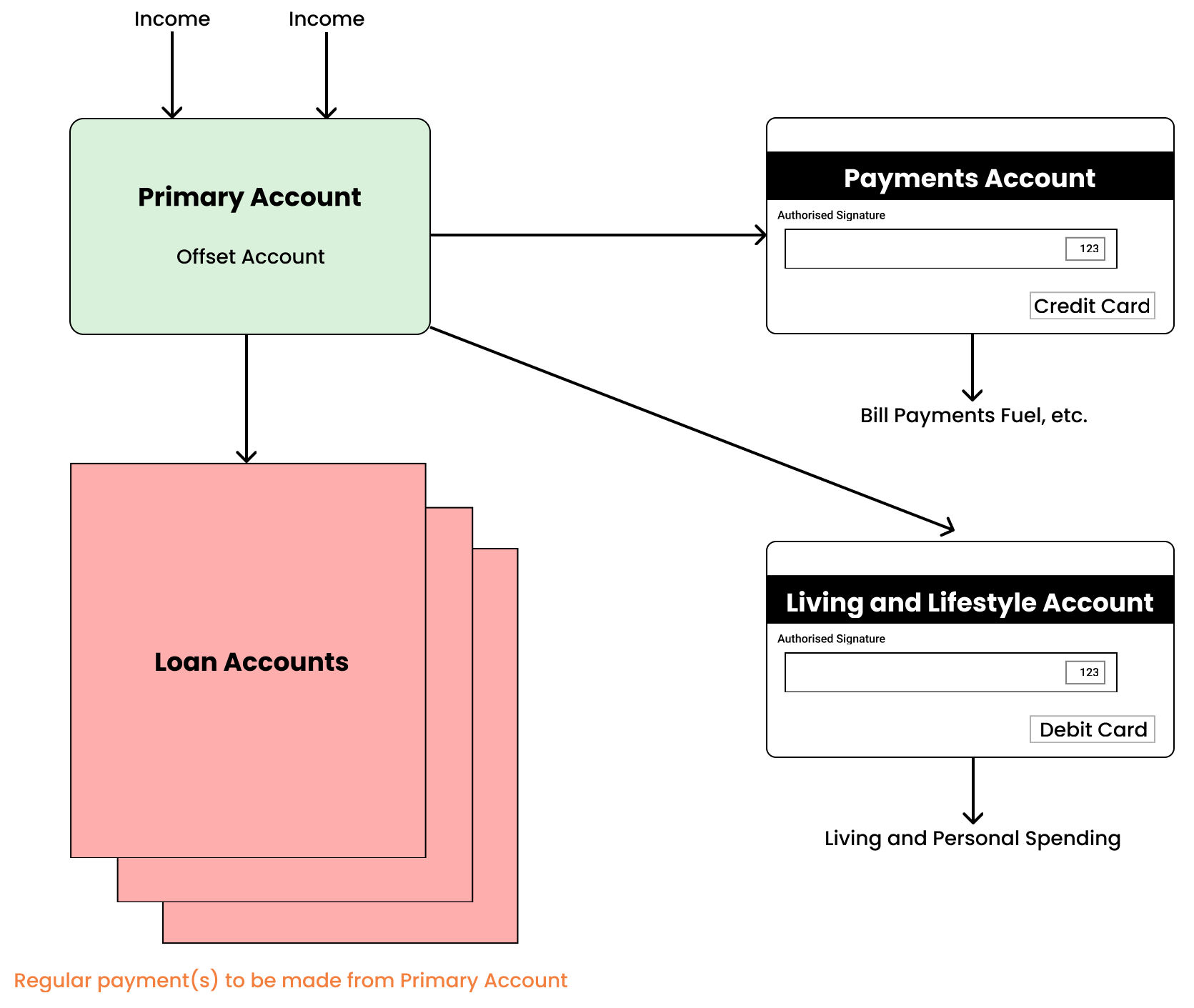

MoneySMARTS is a way of managing your money and cashflows to make it easier to control unintentional or inadvertent overspending, with the focus on capturing surplus cashflow to reduce levels of debt and increase savings for the future.

The basic MoneySMARTS structure is laid out in the diagram below, though as a summary, it is a way of structuring your Bank Accounts to help make saving and trapping surplus more ‘automatic’.

What changes can you expect in MoneySMARTS 2.0?

Platform: Web App and Mobile App

Expected Release Date: October 2024

Traditional MoneySMARTS suggested that users maintained a single Primary Account and single Credit Card Account. However, with Moorr now allowing you to track all of your financial information on a historical level and modern banking system setups allowing for multiple linked offsets, coupled with the desire for younger couples to track their finances somewhat separately in individual accounts without combining them in joint accounts, MoneySMARTS needed an update to ensure that the check-ups and tracking could cater for historical changes to circumstances to be tracked for insights and allow two-way connectivity to the overall Moorr’s MyFINANCIAL Cards and insights.

With that said, MoneySMARTS 2.0 hopes to:

- Upgrade the check-up functionality to allow for two-way balance updates to your MyFINANCIAL Cards and MoneySMARTS.

- Prepare MoneySMARTS with the ability to record balances to/from multiple bank accounts and credit cards for planned future automation functionality.

- Use historical tracking to properly track balances and tweaks through existing and past periods (though we still recommend using the rollover function for major changes).

- Incorporate the tracking of transactions on cards that have been archived within a period, so that they are not lost.

- Properly track minor tweaks to financial circumstances, so that when you make a cashflow related change in a month, previous tracking history does not get affected.

- Allow users to rollover when a period is incomplete and allow a user to modify the current period’s start date.

- Tweak the reporting table to be more readable with added tooltips for definitions.

Here’s quick preview and demo of how the updated MoneySMARTS 2.0 check-up functionality works to integrate your MyFINANCIAL Cards.