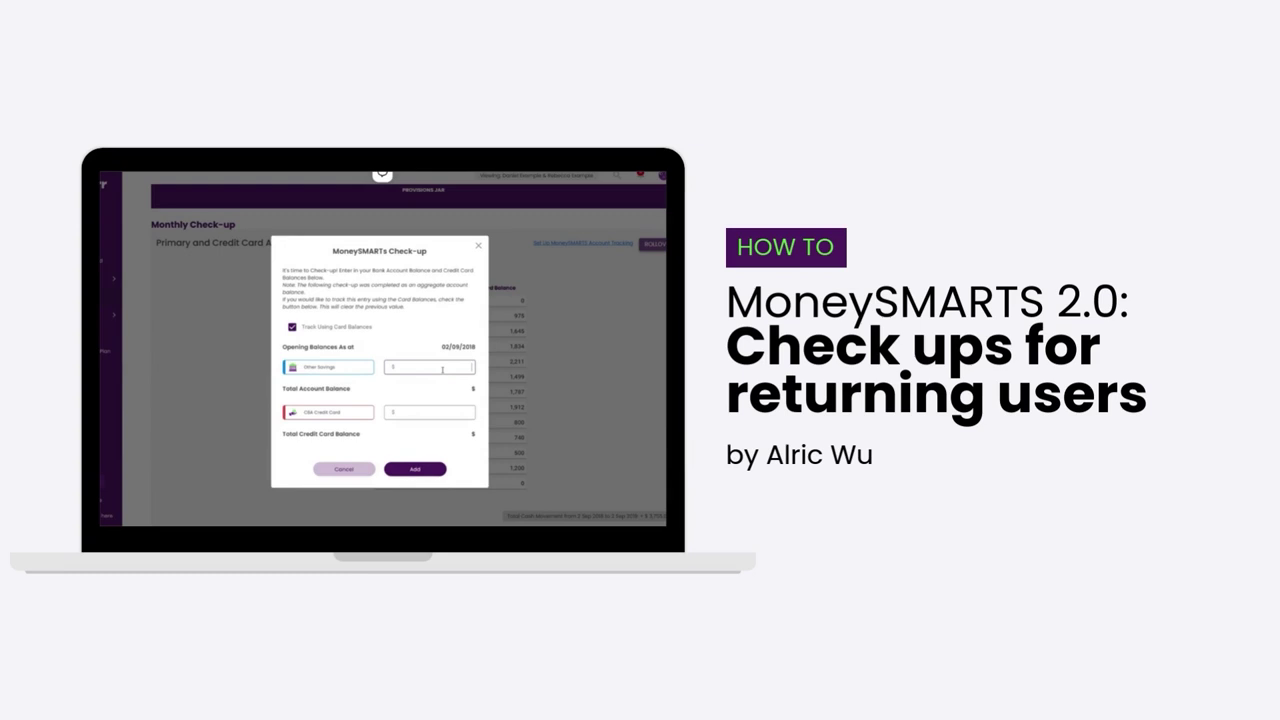

Keeping your finances up to date is essential, and with MoneySMARTS 2.0, recording a checkup has never been easier. In this guide, we’ll walk you through the step-by-step process of recording a checkup, ensuring your financial data is always accurate and aligned with your budget.

By the way, please note that this blog is catered for users who are recording their MoneySMARTS check up for the first time. If you’re a long time user of MoneySMARTS and has previously entered data in MoneySMARTS 2.0, please check out our other blog called MoneySMARTS Check Ups for Returning Users here instead.

What is a Checkup in MoneySMARTS 2.0?

A checkup helps you record the latest balances for your accounts and credit cards, ensuring all your financial information is current. With MoneySMARTS 2.0, any changes made during a checkup are reflected not only in the checkup area but also in your bank accounts and credit cards, creating seamless two-way tracking.

Please Note: Although the demo video is on our web app, this feature is also available on our Mobile app! The steps on both the web and mobile are the same. ☺️

For a detailed walkthrough, watch our step-by-step video tutorial:

Step-by-Step: How to Record a Checkup in MoneySMARTS 2.0

- Select the Checkup Month:

Navigate to the checkup page and click on the month you want to report. - Enter Opening Balances:

Input the opening balances for the specified accounts and credit cards on the selected date. - View Account and Credit Card Balances:

The total account and credit card balances will appear for the chosen date. If no balances are shown, this could indicate that bank accounts are not set up yet. - Troubleshoot Missing Accounts:

If prompted with an error message stating no bank accounts are set up, click on the “Set Up MoneySMARTS Tracking” button or the error message itself to specify the accounts you want to track. - Directly Add Balances from Accounts:

Alternatively, enter balances directly into the bank account or credit card change logs. This data will sync automatically with the MoneySMARTS checkup.

Why Regular Checkups Matter

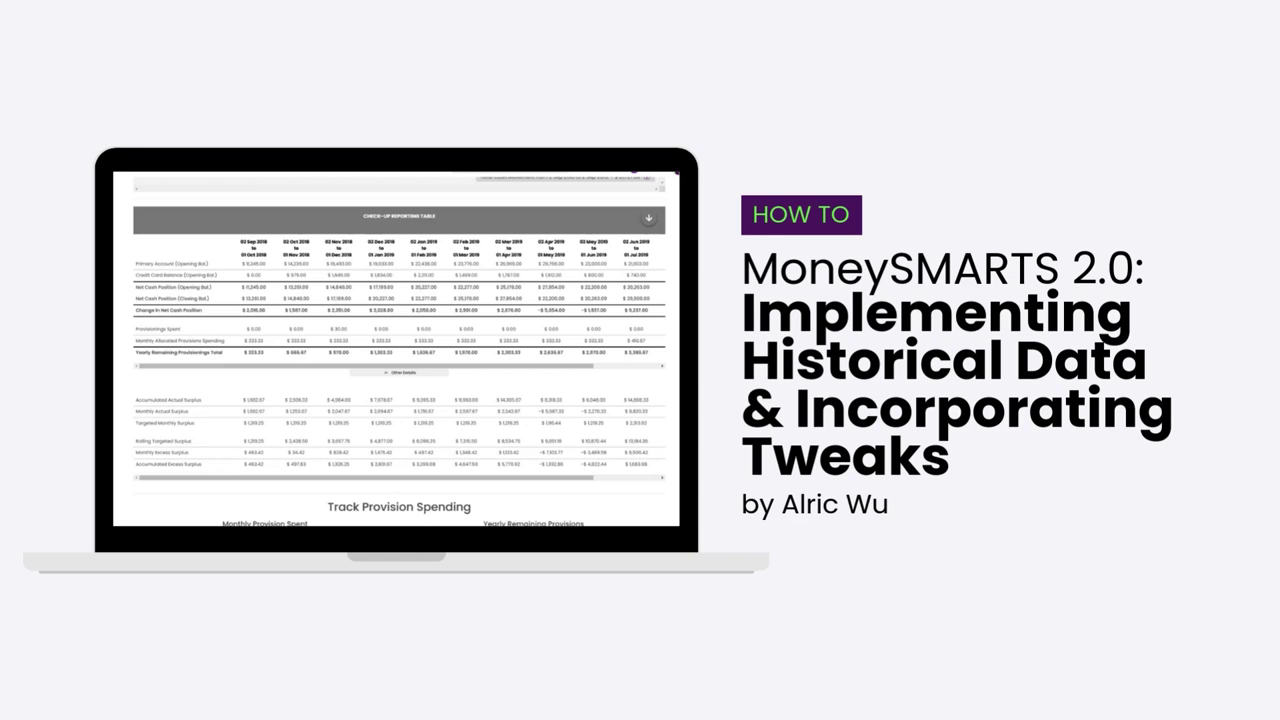

- Accurate Tracking: Keeps your financial data current and helps monitor cash flow.

- Two-Way Syncing: Any changes made during checkups are reflected in your bank accounts and cards, preparing your finances for future automation.

- Customised Tracking: Choose which accounts you want to include in your checkup to suit your financial needs.

Pro Tips for Recording Checkups

- If you encounter missing data, review your bank account settings and ensure tracking is enabled for the relevant accounts.

- Regular checkups allow you to catch any discrepancies early and adjust balances as needed.

- Use the historical logs to view changes across periods and maintain accurate records.