Set Up MoneySMARTS Account Tracking – What is it?

With MoneySMARTS now being linked into your MyFINANCIAL cards and historical tracking, all users will be moved to the MoneySMARTS 2.0 method of Tracking. However, because MoneySMARTS has previously operated with a single Primary Account Balance and Credit Card Balance, the new Set Up MoneySMARTS Tracking button is designed to help users Set Up their MyFINANCIAL Cards for two-way tracking with the MoneySMARTS System, so that updates via MoneySMARTS checkups can automatically be recorded in their MyFINANCIAL Cards and vice versa.

Why was this done?

Nowadays, it is quite common for households, whether individual or couples, to hold multiple bank accounts and credit cards. MoneySMARTS 2.0 recognises that rather than having a single ‘Primary Account Balance’ and ‘Credit Card Balance’, in these cases, many users were simply summing up the totals from their account balances to record into MoneySMARTS.

As such, this function has been introduced to allow you to choose the Bank Accounts and Credit Cards you want to track in MoneySMARTS by tracking the individual balances of each account, rather than having to manually update and sum up values independently on a regular basis.

Set Up MoneySMARTS Account Tracking - How do I use this?

Using the Set Up MoneySMARTS Tracking function helps you set up the Bank Accounts and Credit Cards that you wish to track within MoneySMARTS.

Please Note: Although the demo video is on our web app, this feature is also available on our Mobile app! The steps on both the web and mobile are the same. ☺️

How it works:

- A new field called ‘Track in MoneySMARTS’ has been introduced to all Bank Accounts, Credit Cards and Line of Credits.

- MoneySMARTS 2.0 will check to see if the Bank Account/Credit Card has been enabled as ‘Track in MoneySMARTS’ on the specified check up date and include the MyFINANCIAL Card in MoneySMARTS from that date onwards.

- If you want to stop tracking a MyFINANCIAL Card within MoneySMARTS you can set the ‘Track in MoneySMARTS’ field to ‘No’ from your selected date onwards.

How to enable it:

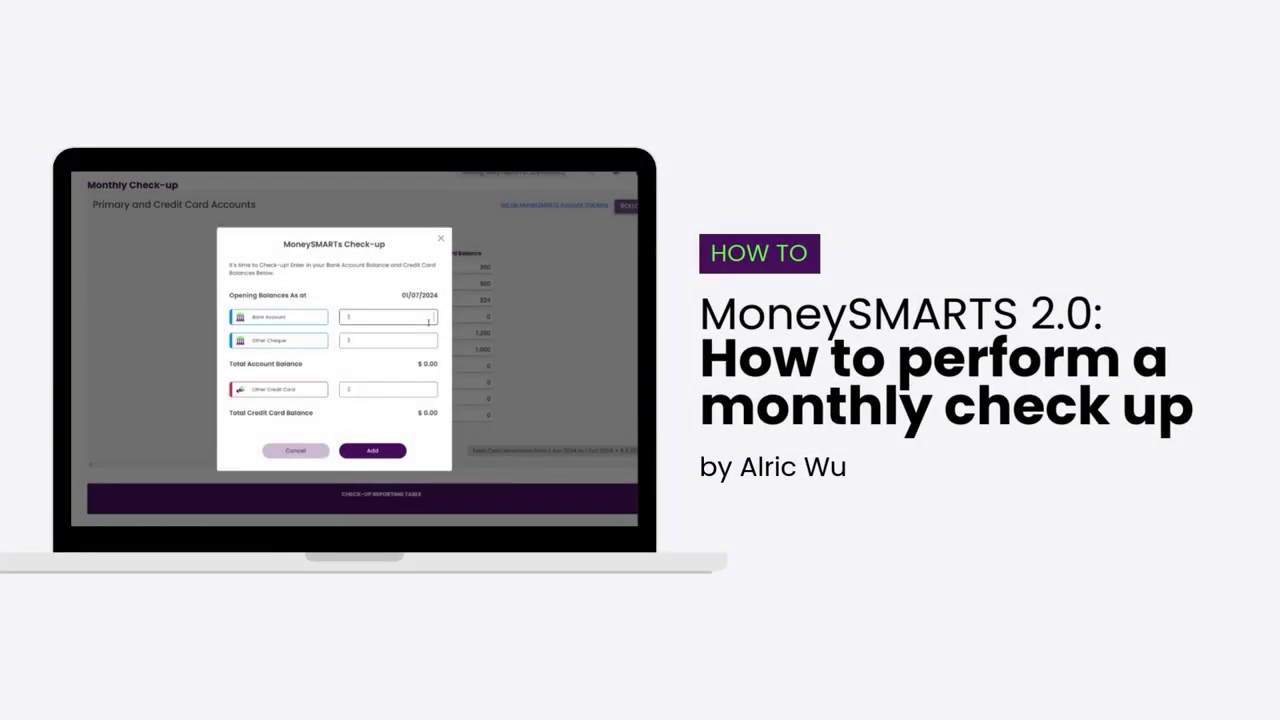

- Click on the ‘Set up Tracking in MoneySMARTS’ button.

- Select the date from which you’d like to start tracking these Bank Accounts/Credit Cards.

- For example, if your current MoneySMARTS Period has a Start Date of 1 January 2024, and you want to start tracking the individual Bank Account/Credit Cards from that date, you only need to set this up once from 1 January 2024.

- Select the Bank Accounts and Credit Cards you’d like to include in MoneySMARTS tracking.

- Click ‘Confirm’.

- Each check up month will now display the selected Bank Accounts and Credit Cards.

Note:

- The Steps above are the same on both our mobile apps (on iOS and Android) and web app.

- Whenever you create new Bank Accounts or Credit Cards, we’ll automatically set this field to ‘Yes’ to be tracked in MoneySMARTS on the date of creation. Whenever you create new Lines of Credits, we’ll automatically set this to ‘No’ on the date of creation.

- You can also individual modify the Track in MoneySMARTS field’s historical values within each individual MyFINANCIAL Card (Bank Account, Credit Card, Line of Credit only)

Frequently Asked Questions

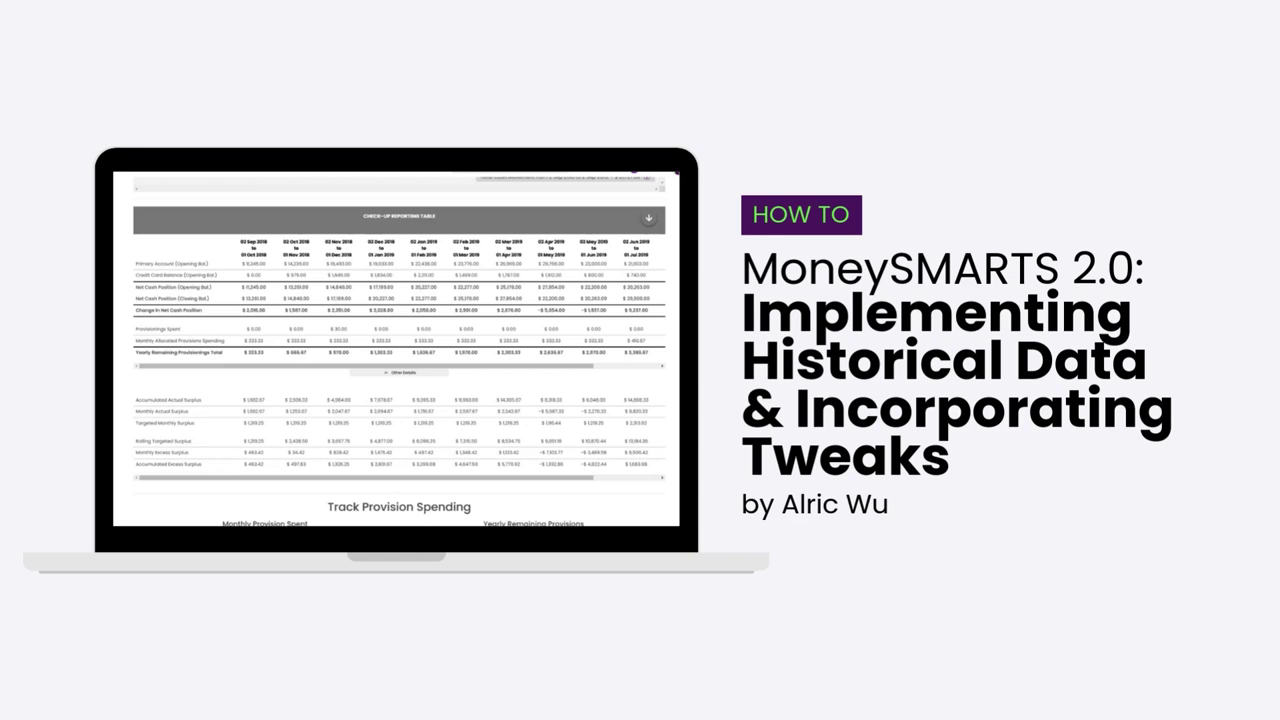

It is important to note that MoneySMARTS 1.0 recording a single Primary Account Balance and Credit Card balance. With MoneySMARTS 2.0, data will be entered directly into your MyFINANCIAL Card’s historical tracking area and vice versa, removing the need for double entry and allowing for individual account balances to be recorded at the same time.

What this means is that if you had multiple bank accounts or credit cards, you would either have elected to sum them up into a single balance when recording it in your Check Up area, and potentially recorded these in your MyFINANCIAL Cards independently, or only recorded a single account’s balance.

With MoneySMARTS 2.0, you can now elect to update each of the bank account and credit card balances independently.

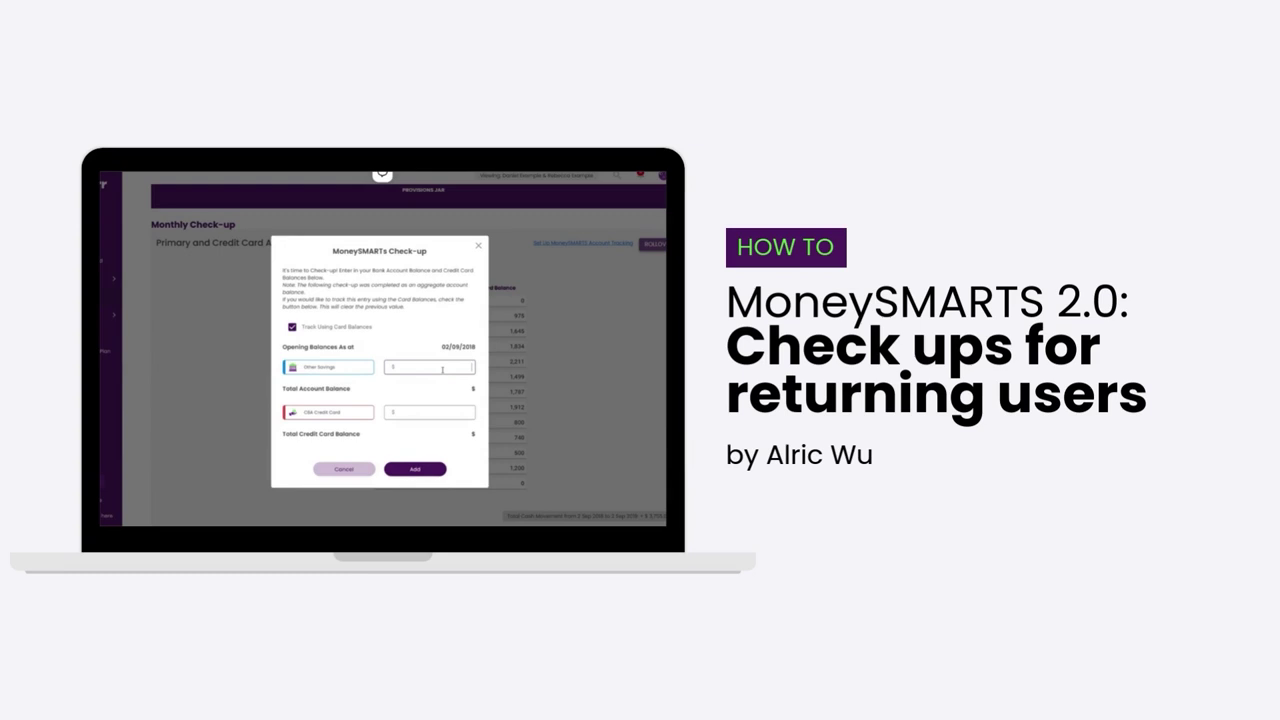

Because legacy MoneySMARTS 1.0 uses an aggregate sum that is separately tracked and MoneySMARTS 2.0 is designed to work together in harmony with Moorr to prevent double tracking, your next checkup will automatically be designated to use MoneySMARTS 2.0.

If you already have check up information in Moorr, there’s nothing to worry about. We’ve kept these here so that they still work, and even if you’ve set ‘Track in MoneySMARTS’ to prior to one of these check ups, your data will still be retained. Your MoneySMARTS 1.0 check up information is still retained and utilised, however you’ll have the option of choosing to track using Card Balances instead of the aggregate sum for each of the existing checkups already performed.

Selecting this option will display all MyFINANCIAL Cards with ‘Track in MoneySMARTS’ set to ‘Yes’ as at that checkup date.

Your Expenses already contain the option to set a MoneySMARTS Jar, whereas the ‘Set up Tracking in MoneySMARTS’ tool helps integrate your bank accounts and credit cards used for MoneySMARTS with Moorr’s MyFINANCIALS to prevent double entry and allow for faster checkups.

If you want to manage your MoneySMARTS expenses, the fastest and most convenient way to do this is to use the Bulk Edit or Bulk Add feature within MyFINANCIALS. Here, you’ll be able to modify each expenses data as well as the MoneySMARTS Jar.

It’s important to note that the ‘as at’ date in which these changes take place will be the date they are also reflected within MoneySMARTS.

You can read more about the bulk add/edit features here.

The new tracking field has been introduced on all bank accounts, credit cards and line of credit MyFINANCIAL Cards. This field determines whether or not the selected Card will be tracked in MoneySMARTS, and if selected as ‘Yes’ will appear as part of your checkup balances to update on a monthly basis.

For our existing platform users, existing bank account and credit card MyFINANCIAL Cards will be automatically set to ‘Yes’. Past MoneySMARTS Checkups will be still be retained as a singular balance figure, so changes to past values and checkups won’t be necessary, though you’ll have the option to move these to the tracking method.

For existing users still wishing to retain a singular Primary Account tracking method, you can disable the ‘Track in MoneySMARTS’ in the Cards Details going forward.

MoneySMARTS 2.0 Check Ups are designed to record and retrieve just the bank balances on the specified Check Up dates, for example on the 1st of every month. This means that if you have other values entered in the historical logs for your bank account or credit card MyFINANCIAL Cards, these will not be retrieved, as they are not reflective of the ‘Opening Balances’ on the 1st of the month.

This approach was taken as we are preparing Moorr to be able to automatically retrieve, read and display information on specific dates.

Benefits of Two-Way Tracking

- Time-Saving: No more duplicate entries—update once, and the data reflects everywhere.

- Flexible Tracking: Enable or disable accounts based on availability or usage.

- Improved Accuracy: Seamless integration ensures consistent data between your checkups and accounts.

- Ready for Automation: Future platform updates will leverage this setup for enhanced automation.

Pro Tips for Account Tracking

Pro Tips for Account Tracking

- Use the tracking wizard to manage bulk updates across multiple accounts.

- Keep your historical logs clean and updated by ensuring accounts are accurately tracked within the correct periods.

- For new users, tracking is automatically enabled for you.