In MoneySMARTS 2.0, users now have the flexibility to change the start date of their financial periods with ease. This feature ensures that you can align your tracking with specific financial events, giving you greater control and precision over your budgeting.

Why Changing the Start Date is Important

Your financial situation may not always align with predefined periods. Whether you need to adjust a date to match your pay cycle or capture expenses accurately, changing the start date ensures that your data reflects your actual financial reality.

Please Note: Although the demo video is on our web app, this feature is also available on our Mobile app! The steps on both the web and mobile are the same. ☺️

For a detailed walkthrough, watch our step-by-step video tutorial:

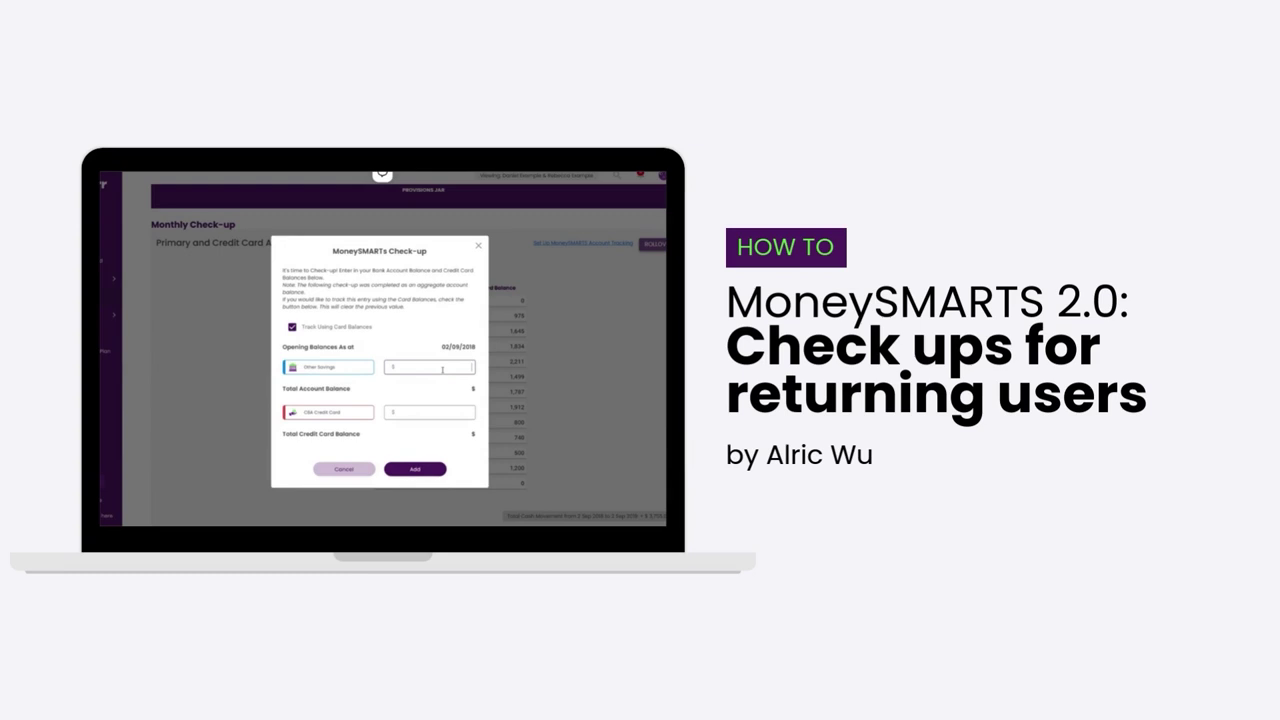

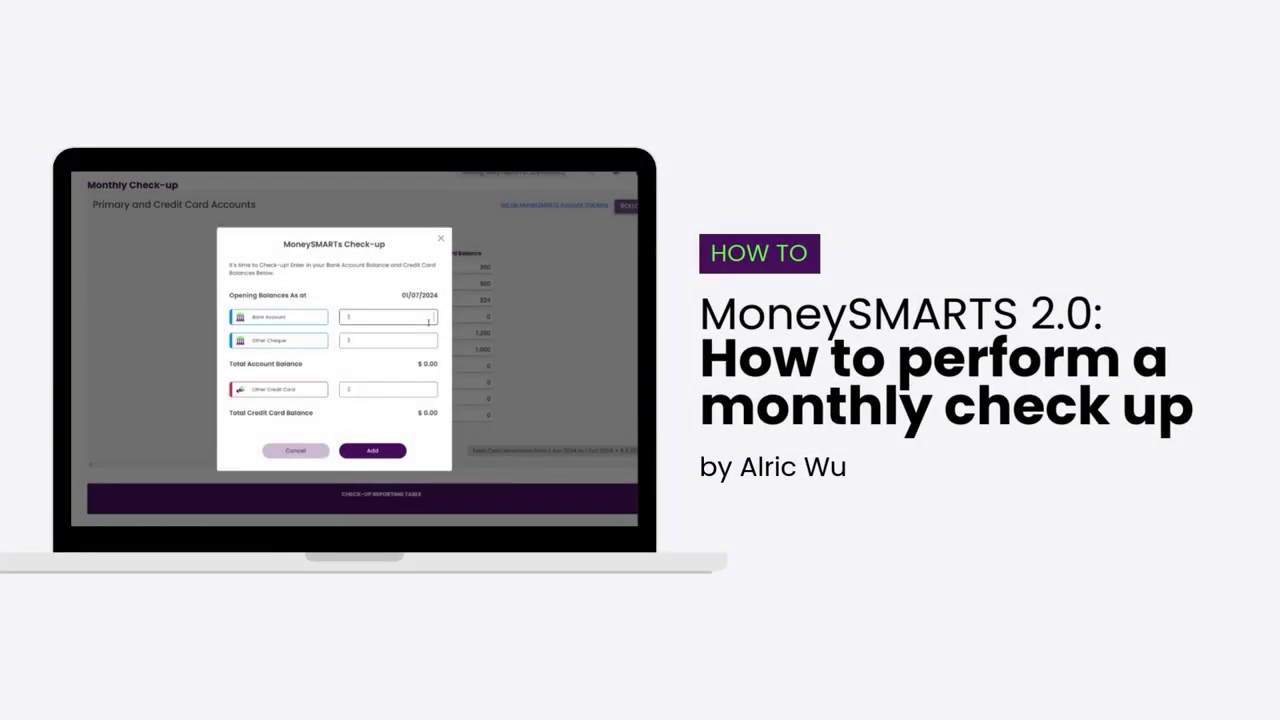

Here are a few things to note when on How to Change Start Dates:

- Select the Start Date Field:

Navigate to the checkup period and click on the start date field to enter your desired start date. - Understand How Balances Are Pulled:

Balances are recorded based on the exact checkup dates. For instance, if you set your start date as 2nd September, the platform will pull the opening balance for that date. - Switching to New Dates:

If you change the start date (e.g., from 2nd September to 1st September), and no balance was recorded for the new date, it will appear blank until you add a value. - Historical Tracking Maintains Data Integrity:

Any changes made to start dates or periods are reflected in historical tracking, ensuring that no data is lost. - Adjusting Periods as Needed:

If you need to cut a financial period short, you can roll over to a new one. The system will guide you to set up a new period seamlessly.

Pro Tips for Managing Start Dates & Rollovers

- If you’re switching to a new start date, ensure that account balances are updated to reflect the change.

- Use the historical logs to view previous entries and adjust your data if needed.

- If you encounter blank balances, revisit the bank account or credit card entries to enter missing values.

Benefits of Flexible Start Dates & Rollovers

- Adapt to Your Changing Finances: Change your checkup dates based on when your income or expenses change.

- Accurate Reporting: Ensures balances are tracked based on specific dates for precise reporting.

- No Data Loss: Historical tracking means your data is always retained, even if changes are made to start dates.

Manage Your Finances Your Way with MoneySMARTS 2.0

Take control of your financial journey with MoneySMARTS 2.0 on Moorr. Change start dates, roll over periods, and make sure every dollar is tracked precisely—just the way you want it.

📲 Get started with Moorr today: Download Moorr app on Apple here and Moorr app on Google Playstore.