Returning to MoneySMARTS and diving into 2.0?

Whether you’ve been with us from the early days or are just re-engaging, transitioning your legacy checkup data to the new system is simpler than ever. MoneySMARTS 2.0 introduces powerful features like card tracking and automated functionality to make managing your finances smarter and more intuitive.

In this blog, we’ll walk you through managing legacy data, updating your checkups with card balances, and ensuring a seamless transition to the new system.

Transitioning Your Legacy Data

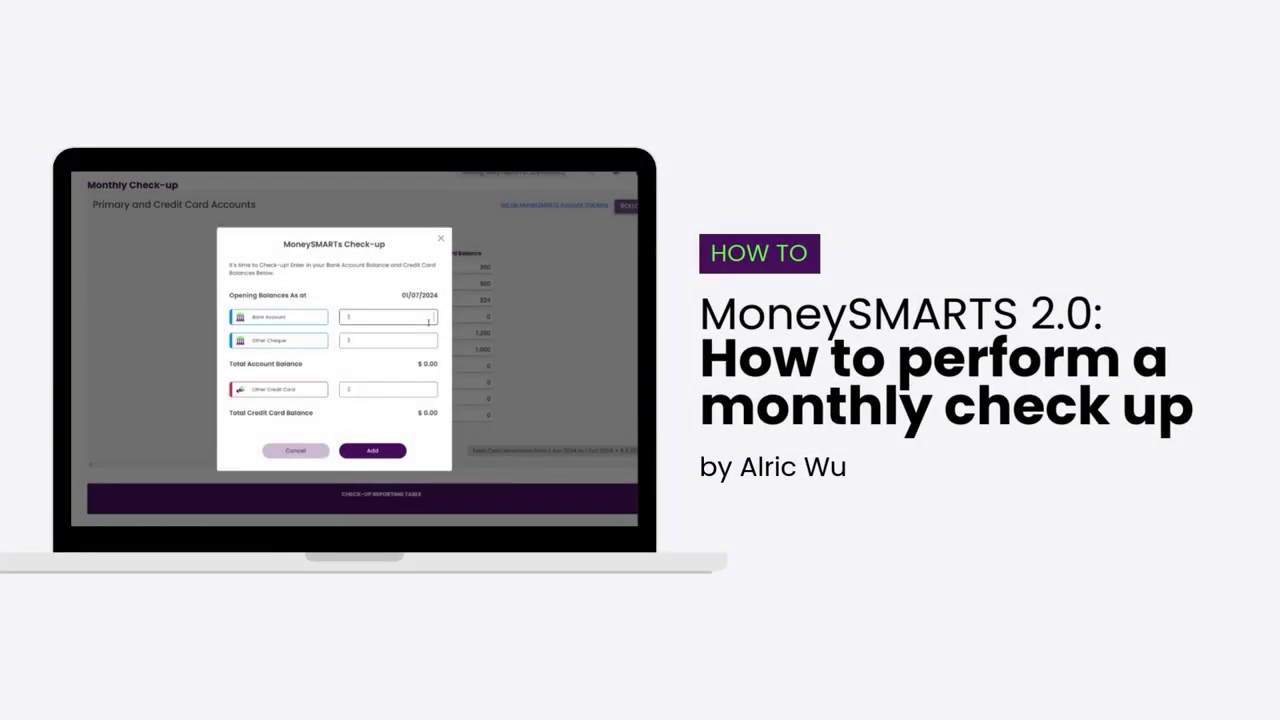

With MoneySMARTS 2.0, your checkup process now leverages card balances to improve accuracy and reduce manual effort. If you’re a returning user, the first step is to update your past data so it aligns with the new system. This ensures that all your future checkups benefit from the streamlined features MoneySMARTS 2.0 offers.

Please Note: Although the demo video is on our web app, this feature is also available on our Mobile app! The steps on both the web and mobile are the same. ☺️

For a detailed walkthrough, watch our step-by-step video tutorial:

Key Steps for Returning Users

Here’s how to manage your legacy data and get up to speed with the updated system:

- Overwrite Past Checkups with Card Balances

Easily replace outdated data by syncing your MyFINANCIALS cards to your historical checkups. This removes the need for manual calculations and double entry. - Select Accounts to Track

Use the new “Track in MoneySMARTS” feature to decide which accounts or cards to include in your checkups. This allows you to focus on the accounts that matter most while ignoring irrelevant ones. - Save Card Balances into Historical Logs

Automatically log card balances into your historical checkups, ensuring a seamless record of your financial history. - Prepare for Future Automation

These updates lay the foundation for Open Banking integration, bringing automated transaction imports to the platform in the near future.

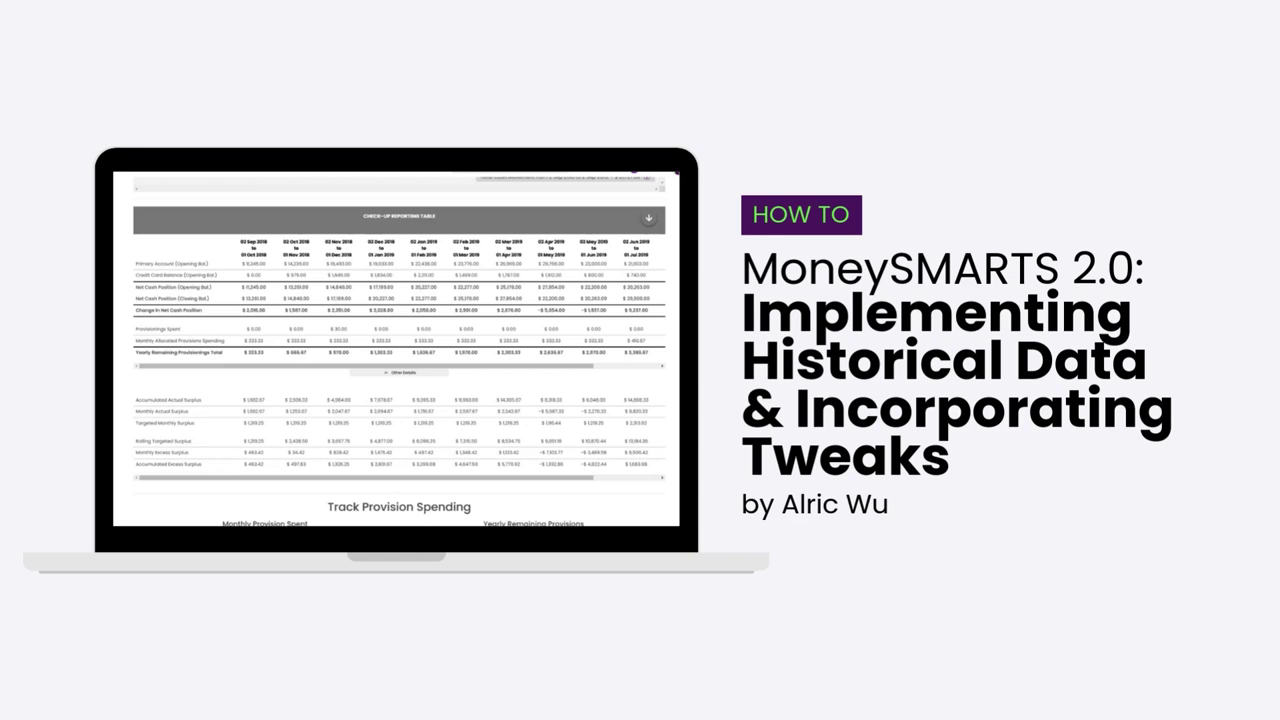

Example: Updating Multiple Months of Data

In the embedded demo video below, we’ll show you how to:

- Enter card balances for multiple months

- Update past periods while maintaining data accuracy

- Ensure consistency as you move forward with MoneySMARTS 2.0

Tips for Managing Multiple Accounts

If you manage multiple accounts, you’ll appreciate how MoneySMARTS 2.0 simplifies the process. The system consolidates balances and tracks them seamlessly across all linked accounts, eliminating the need for tedious manual input.

Ready to Transition?

Watch the demo video below to see the step-by-step process for managing legacy data in MoneySMARTS 2.0. Whether you’re transitioning your past data or starting fresh, these updates will make your financial management smoother, more accurate, and ready for future automation.

👉 Learn more about MoneySMARTS 2.0

👉 Log in to Moorr

👉 Download the Moorr App

MoneySMARTS 2.0 is designed to help you take control of your finances with ease. Ready to explore all it has to offer? Let’s get started!