Your all-in-one property portfolio management tool.

Track equity, cashflow, lending and tax, all in one place.

MyPROPERTY is Moorr’s powerful property portfolio management tool, designed to give you a complete, real-time view of your investments — whether you’ve got one property or ten.

From tracking your equity position and understanding your loan structure, to forecasting your cashflow and potential tax impacts, MyPROPERTY gives you the clarity you need to make smarter decisions — faster.

Just like the rest of the Moorr platform, MyPROPERTY is built by property investors, for property investors, so everything is built with real-life portfolios in mind — not spreadsheets or guesswork.

Moorr is already helping over 19,000 property investors manage more than 35,000 investment properties via our free platform. But until now, those properties were viewed in isolation.

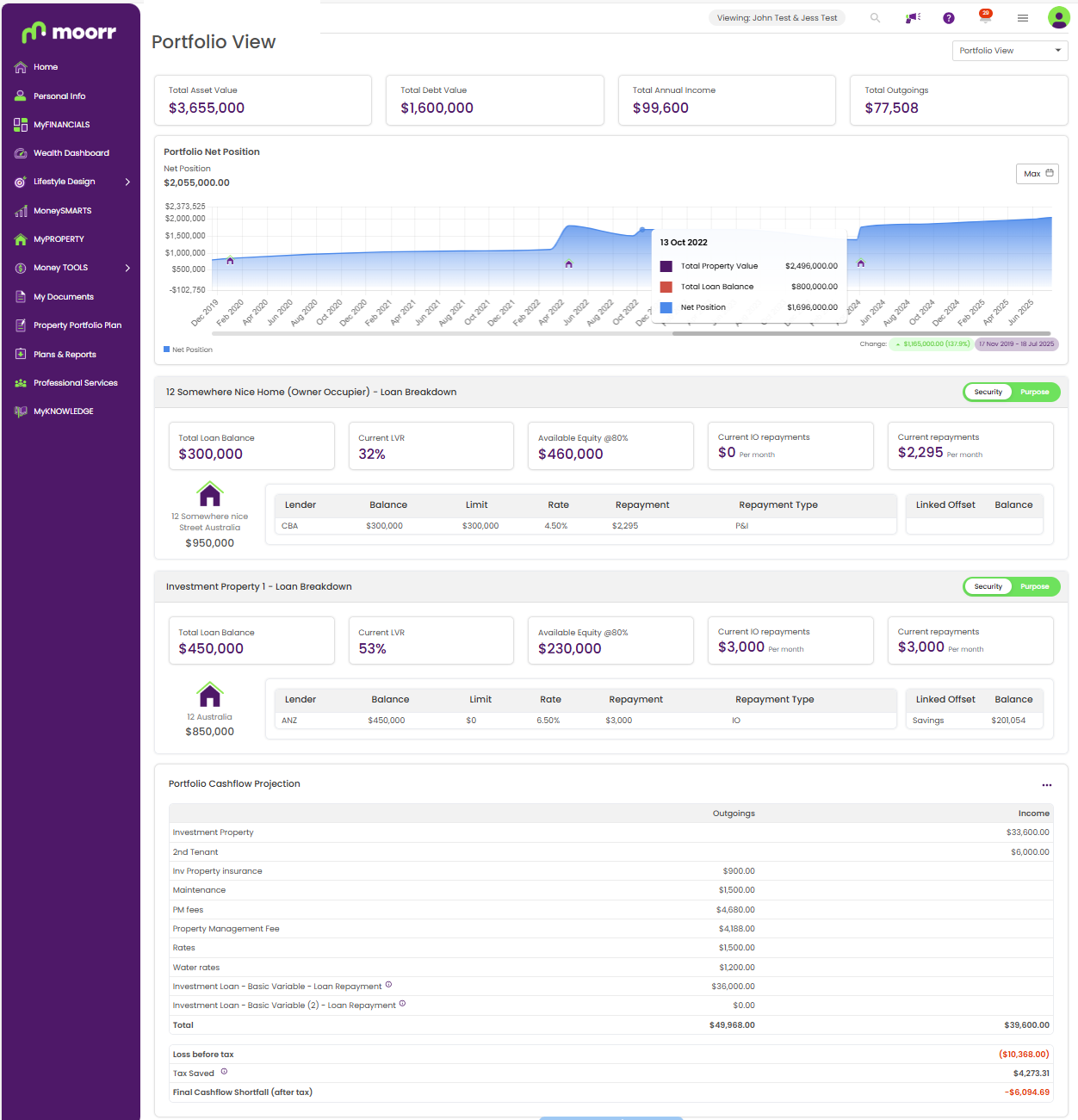

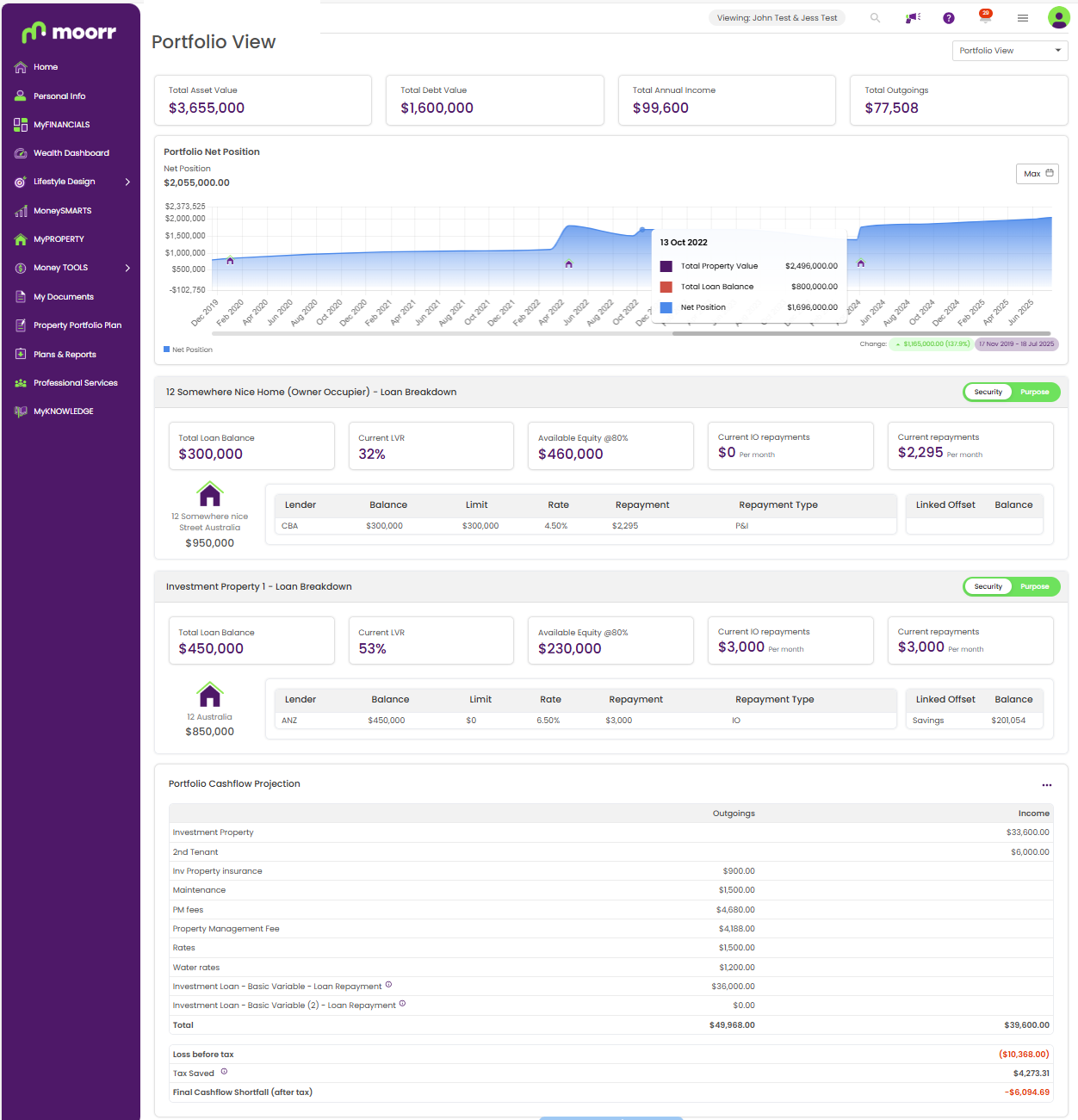

We built Portfolio View to bring it all together — so you can see the sum of all parts. Whether it’s understanding your equity position, tracking loan structures, forecasting tax, or spotting cashflow pressure points, Portfolio View gives you the clarity to act with confidence.

Check out step-by-step walkthrough video below where our product manager shows you exactly how Portfolio View works, including how to:

Perfect if you want to dive a little deeper.

Want to be notified when we have our next LIVE? [Stay in the loop here]

The Portfolio View in MyPROPERTY is more than just a dashboard — it’s a real-time, interactive summary of your entire investment position.

From equity growth to lending structure and future cashflow, this is where Moorr really steps up as a property portfolio management tool. Everything updates dynamically based on the properties you select using the dropdown in the top-right corner.

See your total asset value, loan balance, income and outgoings at a glance. These update instantly based on the properties you’ve selected.

Just below, your Net Position (Equity) chart helps you visualise your property journey over time — showing:

💡 If the chart doesn’t look quite right, check your historic property values inside each asset card.

This section shows you how your loans are structured — either by security (which property secures the loan) or purpose (e.g. investment, business, personal).

Here you’ll find:

This is one of the most valuable parts of the Portfolio View — especially when your portfolio gets more complex.

View a full 12-month forecast of your income, expenses, repayments, and tax impacts across your selected properties.

You can:

This feature helps you spot risks early and plan your finances with confidence.

Here’s a quick look at the MyPROPERTY Portfolio View in action —— tap on any of the green dots to explore each section and see what it all means.

Switch between full, custom, or single-property views.

Key Metrics: See totals across your selected properties.

Track equity growth and property purchases over time.

Shows you when the property was purchased.

Toggle between loan view by purpose or security.

Understand structure, repayments, and available equity.

Forecast income, expenses, tax, and cashflow shortfall.

See projected tax saved or payable across your portfolio.

Switch between full, custom, or single-property views.

Key Metrics: See totals acrossyour selected properties.

Track equity growth and property purchases over time.

Shows you when the property was purchased.

Toggle between loan view by purpose or security.

Understand structure, repayments, and available equity.

Forecast cashflow & tax shortfall.

Projected tax saved or payable across your portfolio.

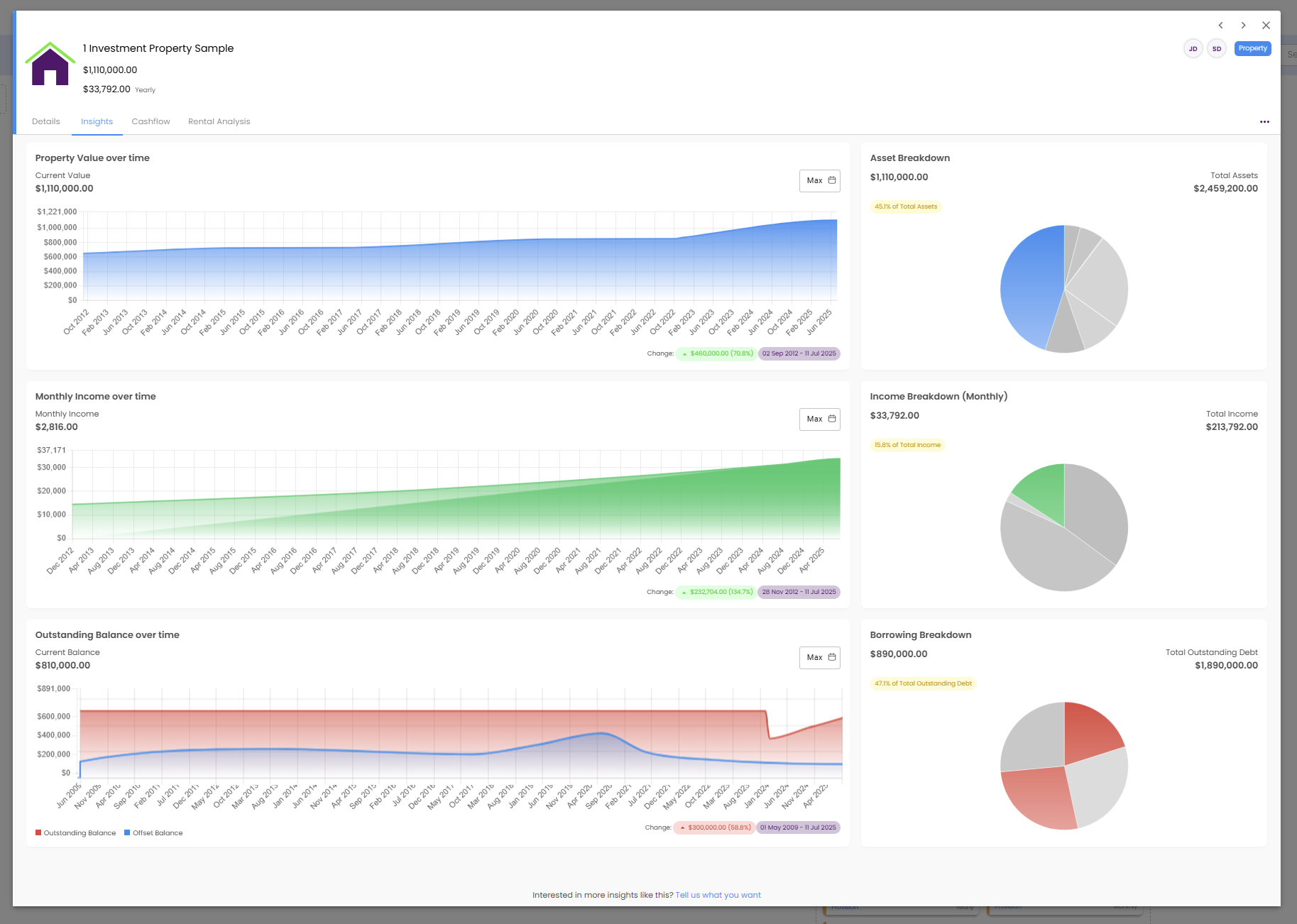

Looking for even deeper insights? These tools go beyond Portfolio View — helping you forecast rental income, track depreciation, optimise your offset account, and manage your property like a business. Expand each one to learn more.

Input your property’s Capital Works and Plant & Equipment values using your depreciation schedule.

See how depreciation impacts your annual tax position and cashflow forecast.

View and compare annual rental income and operating expenses for each of your properties.

Track how they evolve over time and ensure you’re managing your property like a business.

See how your offset account is impacting your loan interest and long-term cashflow.

Helps you optimise your cash reserves and borrowing strategy with clarity.

Not just yet — but it’s coming!

Right now, the best experience is on the web app, where you’ve got more space to explore the trendlines, tables and projections clearly across your full portfolio.

But don’t worry — we’re already working behind the scenes to bring this feature to mobile soon. Watch this space!

To display property purchases on the Portfolio Net Position chart, ensure that there is a purchase date in the detail section of the asset card.

The net position is the result of property value minus the loan balance. Although purchasing a property will result in a higher asset base, in the short time it will reduce the net position due to increased debt.

If loans are not appearing in the loan breakdown, ensure that the purpose of the loan and the security of the loan has been selected in Purpose & Security Section in the loan card.

The property values are derived from the purchase price as well as the current value in the property asset card. Using As At dates, we are able to track the value of the property overtime. View the historic log associated with current value to ensure the accuracy of the chart.

The cashflow projection chart utilises income and expense cards which are linked to investment or business type properties to provide a budgeted cashflow.

Following the initial release of the Portfolio View in MyProperty, additional features will continue to expand on property-focused functionality, empowering property investors to better manage and track their portfolios. An upcoming Tenancy page will allow users to record lease agreements, store tenancy details, and set reminders for compliance-related checks and key dates.

Open Banking and integrating bank feeds is a project that we are regularly reviewing.

This feature will enable live updates for transactions in and out of your bank account directly into MyFINANCIALS in the future which would provide a LIVE view of your Property Portfolio Cashflow position. However, it’s a substantial undertaking that will require much time and resources to complete, so it’s not a feature that we are actively working on at the moment.

We will keep our community posted when we’ve decided to get started on this feature.

If you’re keen to implement MoneySMARTS but not sure where to start, then reach out to us! Our Support Team is stoked to tackle any queries you’ve got about Moorr. Whether you’re battling to sort out tricky expenses, reckon you’ve found a bug, or perhaps you’ve got a great idea for the app, we’re all ears!

This following document sets forth the Privacy Policy for this website. We are bound by the Privacy Act 1988 (Crh), which sets out a number of principles concerning the privacy of individuals using this website.

We collect Non-Personally Identifiable Information from visitors to this Website. Non-Personally Identifiable Information is information that cannot by itself be used to identify a particular person or entity, and may include your IP host address, pages viewed, browser type, Internet browsing and usage habits, advertisements that you click on, Internet Service Provider, domain name, the time/date of your visit to this Website, the referring URL and your computer’s operating system.

Participation in providing your email address in return for an offer from this site is completely voluntary and the user therefore has a choice whether or not to disclose your information. You may unsubscribe at any time so that you will not receive future emails.

Your personal information that we collect as a result of you purchasing our products & services, will NOT be shared with any third party, nor will it be used for unsolicited email marketing or spam. We may send you occasional marketing material in relation to our design services.

If you choose to correspond with us through email, we may retain the content of your email messages together with your email address and our responses.

Some of our advertising campaigns may track users across different websites for the purpose of displaying advertising. We do not know which specific website are used in these campaigns, but you should assume tracking occurs, and if this is an issue you should turn-off third party cookies in your web browser.

As you visit and browse Our Website, the Our Website uses cookies to differentiate you from other users. In some cases, we also use cookies to prevent you from having to log in more than is necessary for security. Cookies, in conjunction with our web server log files or pixels, allow us to calculate the aggregate number of people visiting Our Website and which parts of the site are most popular. This helps us gather feedback to constantly improve Our Website and better serve our clients. Cookies and pixels do not allow us to gather any personal information about you and we do not intentionally store any personal information that your browser provided to us in your cookies.

P addresses are used by your computer every time you are connected to the Internet. Your IP address is a number that is used by computers on the network to identify your computer. IP addresses are automatically collected by our web server as part of demographic and profile data known as traffic data so that data (such as the Web pages you request) can be sent to you.

We do not share, sell, lend or lease any of the information that uniquely identify a subscriber (such as email addresses or personal details) with anyone except to the extent it is necessary to process transactions or provide Services that you have requested.

You may request access to all your personally identifiable information that we collect online and maintain in our database by using our contact page form.

We reserve the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use this website. You may contact us at any time with regards to this privacy policy.