Managing cashflow is a key part of financial success, and we’re making it even easier with the introduction of Next Dates in Moorr. This new feature helps predict when key financial events—like income payments, expenses, loan repayments, and super contributions—are expected to occur, giving you better visibility and control over your cashflow.

How Does It Work?

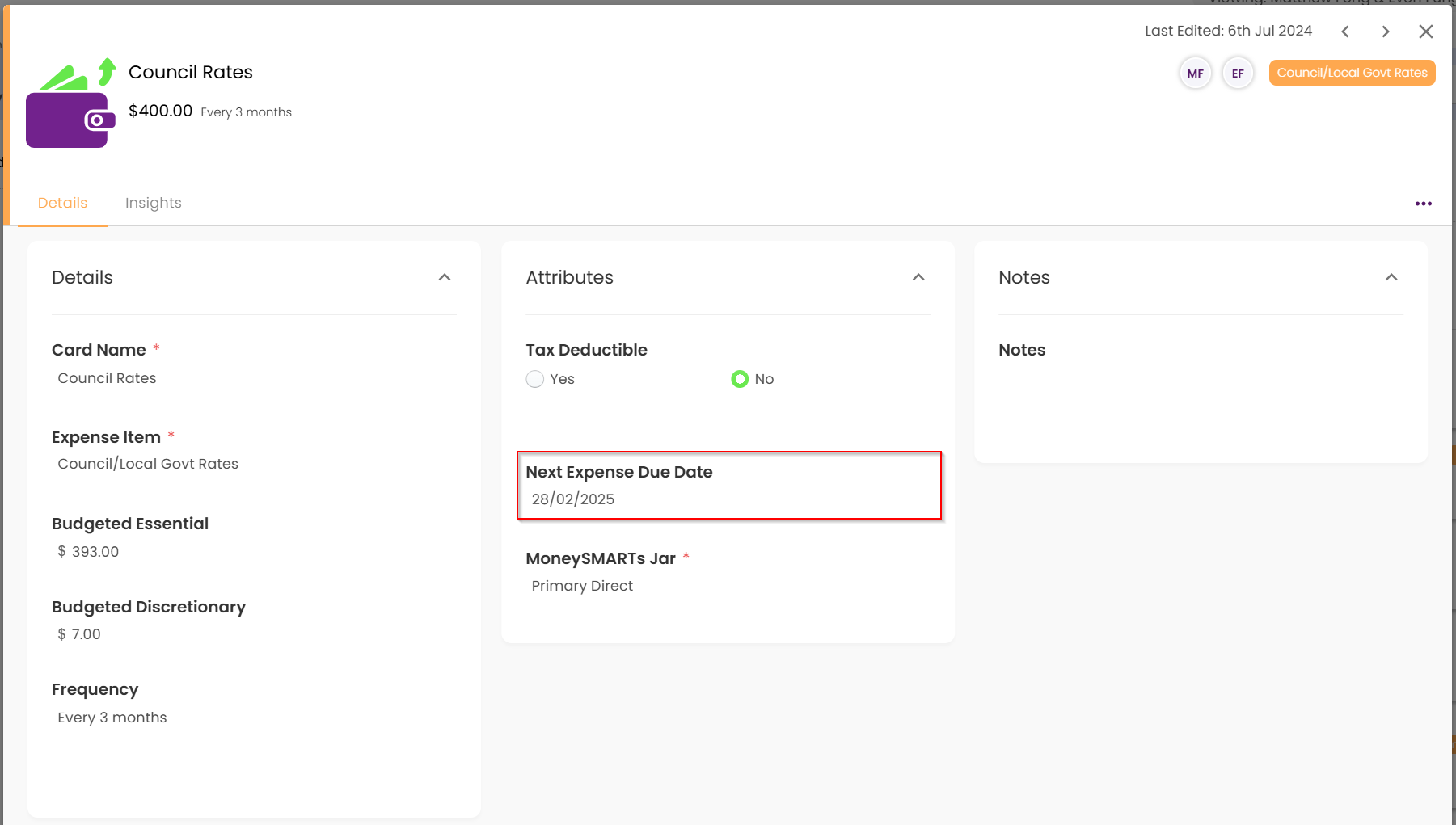

Unlike simple bill payment reminders, Next Dates are dynamic and continuously update to reflect the next expected cashflow event. This means Moorr can now provide a more realistic and accurate cashflow forecast, helping you stay on top of your finances with less guesswork.

What’s Changing?

- All existing bill payment reminders have been migrated to Next Dates, ensuring seamless integration with your existing setup.

- Next Dates lay the foundation for future cashflow management features, helping you plan with greater precision.

Why This Matters for You

Next Dates bring several advantages to help you stay in control of your money:

✅ Never miss an important payment – Track upcoming expenses and income effortlessly.

✅ Better cashflow visibility – See when large outgoing payments are due, helping you plan ahead.

✅ More accurate budget tracking – Compare budgeted vs. actual spending based on when payments actually happen, rather than relying on averaged expenses.

✅ Capture true cashflow variances – Instead of spreading a large annual expense evenly across 12 months, Moorr now reflects the actual month the payment occurs, giving you a clearer financial picture.

This is just the beginning—Next Dates will power even more cashflow management tools in Moorr to help you make smarter financial decisions. Stay tuned for more updates! 🚀