You have just learnt how WealthSPEED™ and WealthCLOCK™ are powerful indicators that deliver powerful and actionable insights inside the Moorr® platform. The same way our other functional tools and insights, such as the MoneySMARTS™ money management system plays a critical role in helping our Moorr® community go about building out their personal wealth success. To demonstrate Moorr®’s vision of how it helps you achieve more, I’m going to finish off this guide by completing the full wealth creation car analogy by showcase other feature sets within Moorr®.

Start with a roadmap. If you want to get to financial peace (and potentially beyond to financial contribution) you need a plan. Using our MyGOALS section is perfect for setting and documenting your big rock in the journey to your lifestyle by design. MoneySMARTS – represents the wealth creation car itself – You can’t go anywhere without a functioning car, wheels, engine, seats lights, windscreen, seatbelts etc. MoneySMARTS is a money management system that give you the fundamentals – Organise, Set Targets, feel in Control of your money and Check-Up on it monthly to see if your ‘car’ is in order to keep driving forward. MoneySTRETCH – If cashflow is the fuel, then MoneySTRETCH is the fuel gauge. It helps you forward project cashflow, basically telling you how much fuel (cashflow) you have in the tank if certain ‘detour’ situations arise. MoneyFIT – Who is in the car with you and how is your car performing to other cars on the road? By giving you an anonymised guide to the same household composition as yours. You will get to see how you compare in areas like income, spending and net worth. To only be used as a guide only, as we are all on our own journeys, but you don’t want to be falling too far behind. 7 Grades of Financial Wellbeing – I mentioned the road map and having a plan. The 7 Grades of Financial Wellbeing at the destinations in which you are going to travel through on this journey. Hopefully you won’t take a wrong turn into Financial Survival or even worse Financial Turmoil, instead we hope you have now passed through financial consciousness, financial stability, financial control and what lies ahead is financial peace, with financial contribution as an optional extra destination.

A post shared by The Property Couch • Podcast (@thepropertycouch)

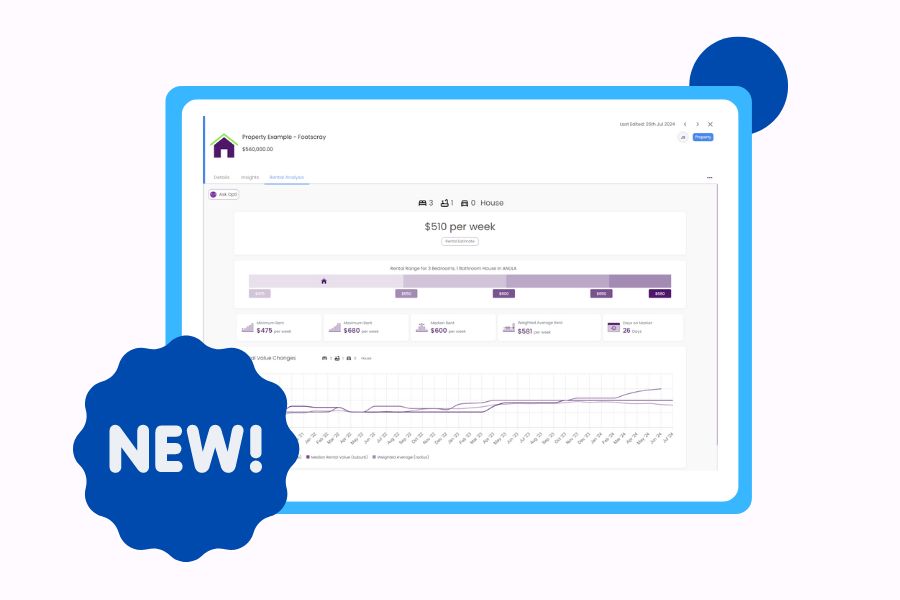

Opti – your smart assistant. Maybe a bit like the 80’s hit series – Knight Rider and ‘Kit’ the intelligent AI built into the car. Moorr® has Opti, which is short for Optimisation and as you travel down your wealth creating path, Opti is going to help you navigate this path with useful and impactful insights along the way to help you optimise your WealthSPEED® as you go.

Well, that’s it for the wealth creation car analogy, for now anyway and it also closes out this handbook. If you want more tutorial video and educational content regarding all the great tools available to use within Moorr® make sure you visit the Knowledge Centre where we unpack and help educate you on property, finance and money management solutions to help you achieve more with Moorr® to create that lifestyle by design you are seeking out.