At Moorr, we’re committed to providing you with the best tools to manage your property investments and finances. We understand the pain points that property investors face, especially when it comes to knowing their investment property’s cash flow. Without a clear picture of your cash flow, it’s challenging to make informed decisions, understand your true profitability, manage your taxes effectively, and plan for future investments. That’s why we’re excited to announce a new release that will take your property investment analysis to the next level: the Cash Flow Projection feature, now available on Moorr’s webapp!

Ever wanted to know how much your property is costing you or how much income it’s bringing it?

What about, how much tax your saving or paying on each property?

Our new Property Cashflow Projection tool is designed to answer these financial questions in simple and clear detail for you.

By giving you this important insight, you get to truly understand the projected financial performance of each property you own. Check out the demo video above to see the new Property Cashflow Projection feature in action. This step-by-step guide will show you how to navigate the feature and get the most out of it.

How to access it?

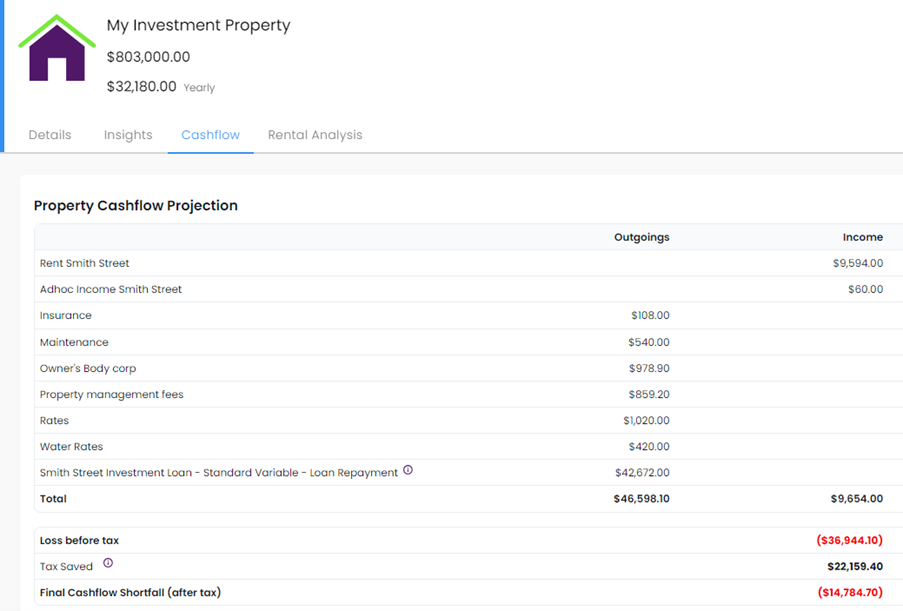

Navigate to your property investment card, and you’ll find a new tab called “Cash Flow.” Here, you will see your outgoings and income based on all the information you’ve entered into Moorr. The table will show you your income, outgoings (including loan repayments), and your total loss before tax. You will also see an estimate of tax saved and the final cashflow shortfall after tax.

What to expect?

The Property Cashflow Projection feature allows you to include all relevant financial details. By navigating to your loans, you can ensure that each loan created for the purpose of purchasing a property is correctly attached. This includes the outstanding balance, interest rate, and current repayment value. An important tip: always make sure your offset is attached to your loans correctly to see the full benefit of having money in your offset account. (Note: Make sure to check out our Offset Tracker tool too!)

Each loan includes an info icon that, when clicked, displays a dialog with detailed information. This includes your repayment value, calculated annual interest based on the entered interest rate, and outstanding balance. The tool also shows the expected offset benefit annualised and calculates your annual interest payable less your offset benefit. This distinction is crucial as interest payable is a deductible cost, while principal repayments are not.

Your taxable assessment for each specific property is also displayed in isolation. This section shows the annual income of individual users and considers the property’s annual depreciation if entered. It calculates your total claimable property loss by subtracting expenses, depreciation, and interest payable on a loan from your income. This results in your total tax saved values. If your property is positively geared, the tool adjusts to show tax payable instead of tax saved. The final output shows the loss before tax, estimated tax saved, and final cashflow shortfall after tax.

This powerful new feature is now live and available exclusively on Moorr’s web app. Log in to Moorr here to see how it can enhance your property investment analysis and help you make more informed financial decisions.

We’re thrilled to bring this new feature to you and look forward to your feedback. As always, our goal is to empower you with the tools you need to build and manage your wealth effectively.